Why is Bitcoin Mining Hashrate Falling?

A Disturbance in the Force

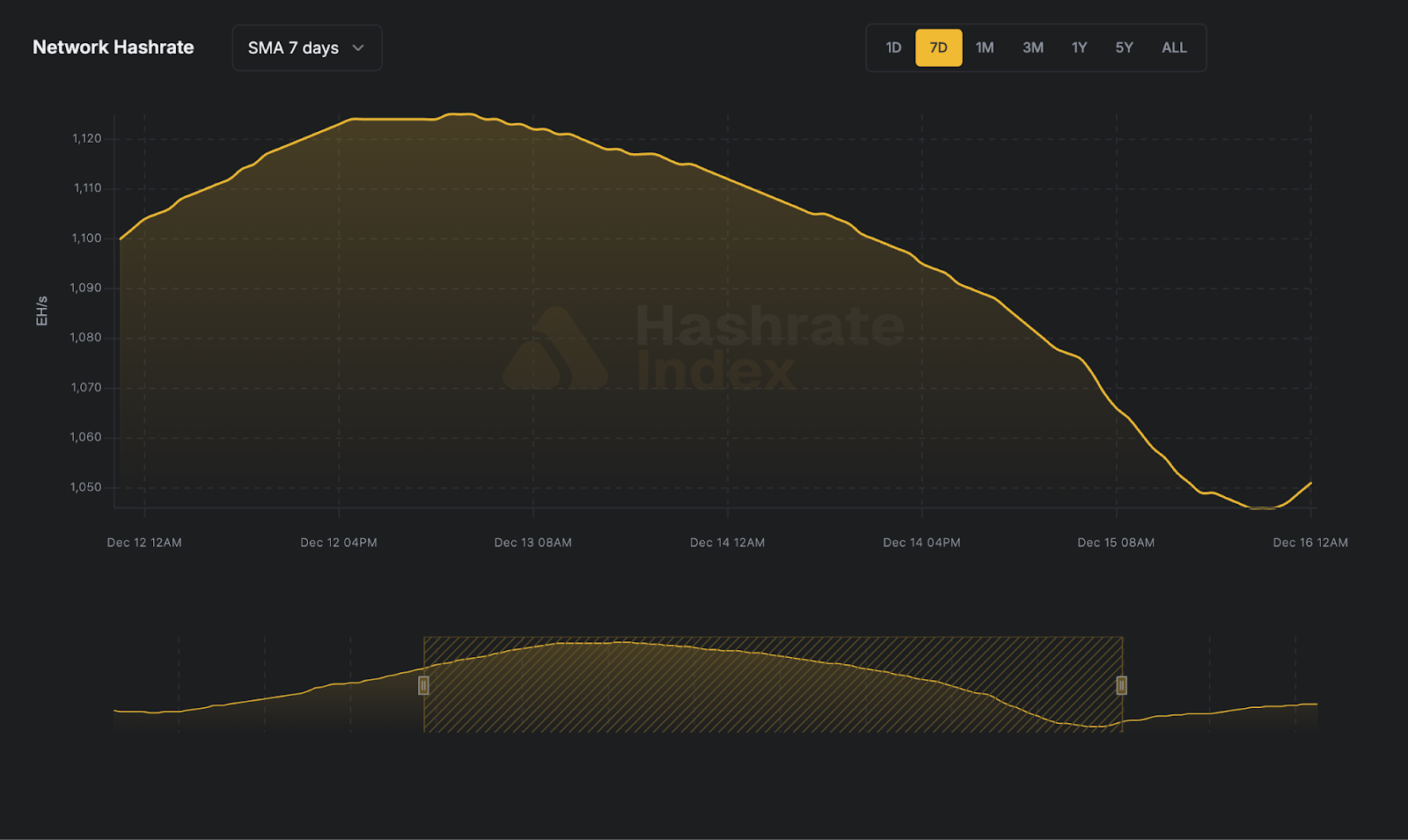

The explosive growth in hashrate since late summer has officially reversed course. In stark contrast to 2025's growth trend, the Bitcoin network has recorded three consecutive negative difficulty adjustments, the first such streak since July 2022. This reflects on the 7-day simple moving average (SMA) network hashrate, which has declined from a peak of ~1,160 EH/s in early October to ~1,045 EH/s (-9.9%) in December. The trend is driven by three factors: declining Bitcoin prices pushing legacy hardware into negative margins, rising winter energy costs triggering seasonal curtailment across North America, and regional enforcement actions removing capacity from major mining regions.

Why Hashrate is Falling

1. Bearish Bitcoin Prices Compress Hashprice

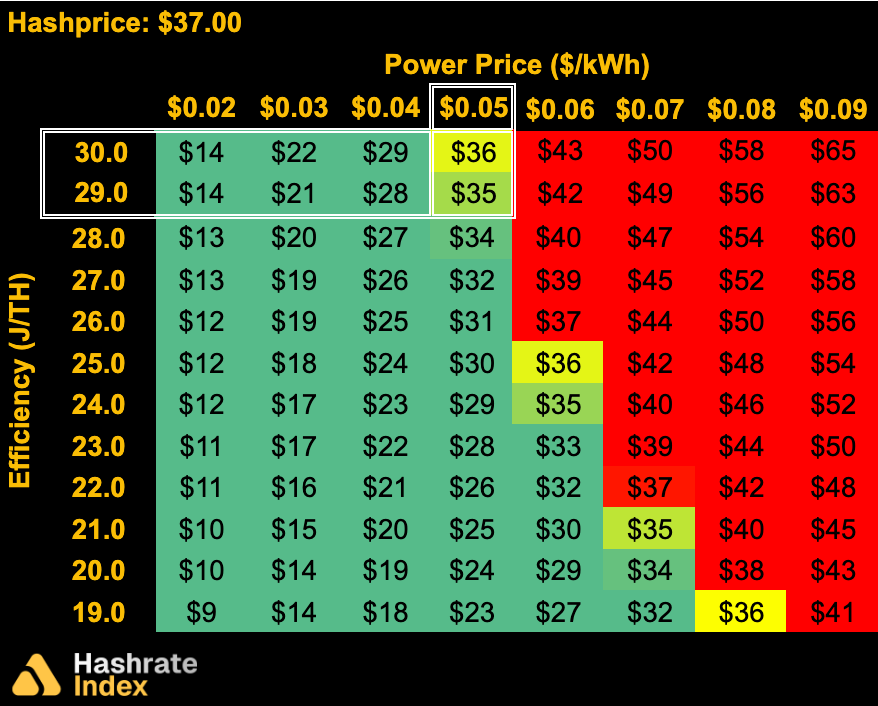

The dominant driver of falling hashrate is economic pressure. In Q4 2025, Bitcoin prices reversed sharply, erasing year-to-date (YTD) gains. From an all-time high of ~$124,485 on October 6, BTC declined to a current level of ~$86,000 (-30.9%). As a direct consequence, dollar-denominated hashprice has compressed to ~$37 per PH/s/Day.

At this level, a meaningful portion of installed hashrate is operating around breakeven. Assuming an average network electricity cost of $0.050/kWh and a fleetwide efficiency of 29.5 J/TH — representative of industrial operations running Antminer S19j Pros — profitability becomes razor thin. These mid-generation fleets account for a significant share of global hashrate, and current conditions are increasingly causing them to shutdown. Assuming BTC prices remain around current levels (~$86,000), Hashrate Index’s latest mining economics projections (Q4-2025) estimates another ~40 EH/s of marginal hashrate dropping offline from a current level of 1,065 EH/s due to unprofitability.

2. Weather-Driven Energy Spikes in North America

On top of revenue compression and regulatory disruption, the cost side of the mining margin is also worsening as winter-driven power demand tightens grids across North America.

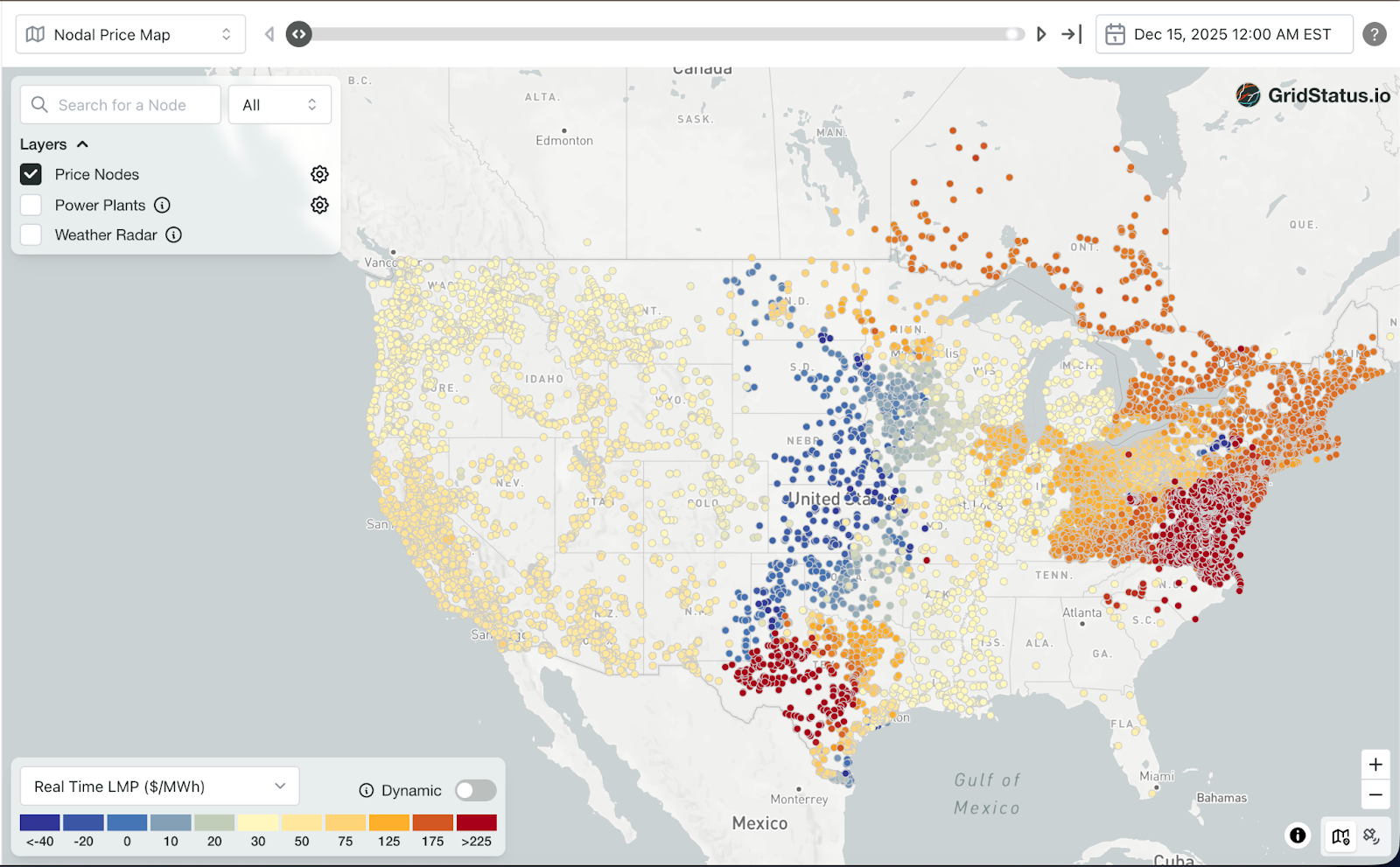

According to Gridstatus.io, a recent cold snap spanning the Eastern Interconnection pushed the Southeast and Middle South into synchronized load stress. Tennessee Valley Authority (TVA), Duke Energy Progress East (CPLE) and West (CPLW), the South Carolina Public Service Authority (SC), and Southern Company (SOCO) all operated near year-to-date peak demand levels, while Associated Electric Cooperative (AECI) in Missouri exceeded 80% of its annual peak. For most of these regions, the rolling 12-month peak was set in late January, underscoring that winter, not summer, defines the true demand ceiling.

This winter synchronicity compresses regional differences that typically provide relief during other seasons. Electric heating demand acts as a common forcing function, pushing load profiles into lockstep as solar output weakens (due to shorter daylight hours) and interchange capacity tightens. During the cold snap, demand for natural gas also increased, further amplifying power price volatility. For miners, these conditions translate into higher marginal power costs, increased curtailment, and additional short-term downward pressure on network hashrate.

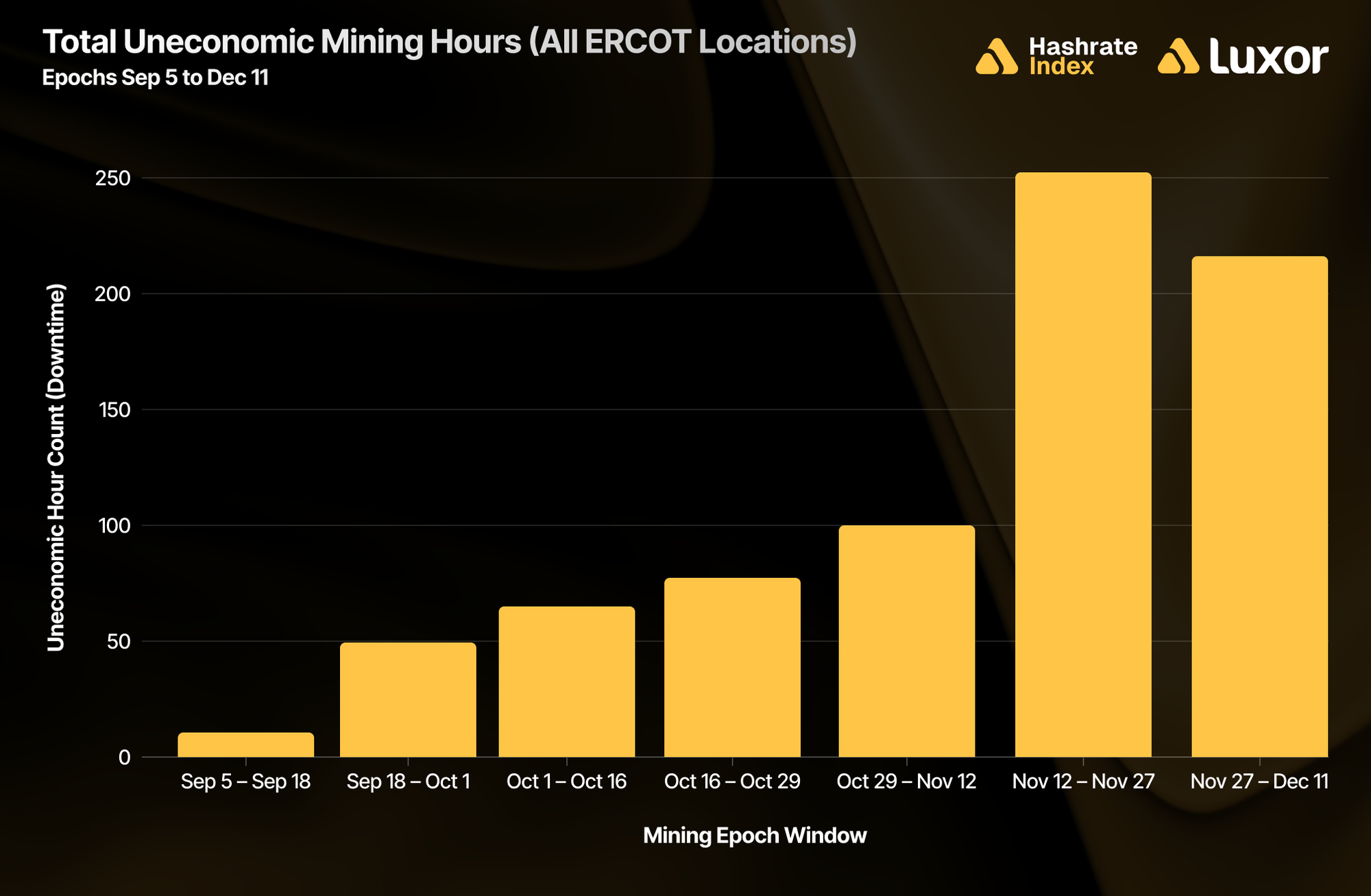

This dynamic is already visible in ERCOT data. The chart below shows the aggregate number of uneconomic mining hours across the past seven difficulty epochs for all ERCOT settlement points. An uneconomic mining hour is defined as any hourly period in which energy hashprice ($/MWh) falls below the average locational marginal price (LMP).

A sharp escalation in uneconomic mining hours can be observed over the past two difficulty epochs, following a steady buildup earlier in the fall. As power prices rose throughout November – December, an increasing number of intervals were pushed above miners’ breakeven thresholds, forcing operations to curtail.

3. Regulatory Scrutiny in Mining Hotspots

The recent hashrate decline may have also been materially influenced by renewed regulatory action in China, centered on Xinjiang.

Luxor’s Head of Hardware, Lauren Lin, reported that beginning around December 13, central government inspections triggered widespread curtailment across mining sites. These actions were framed as rolling inspections rather than a single enforcement event. While equipment has not been formally seized, machines were either left on-site or relocated to government-designated, controlled warehouses under local authority supervision. This process reduces near-term recovery expectations and increases ongoing operational uncertainty.

From a market perspective, the impact remains operational rather than structural. The affected hashrate largely remains within Xinjiang, with no evidence of forced liquidation or broad hardware displacement. Importantly, much of this capacity is controlled by a small number of medium-to-large, well-capitalized operators, limiting spillover effects into hardware markets.

Regulatory pressure has also intensified in Russia, where authorities recently moved to ban mining in multiple regions, citing power shortages and grid stability concerns during peak winter demand. While the affected hashrate is smaller and more fragmented than in China, this policy reinforces a broader trend: jurisdictions facing energy stress are increasingly willing to curtail mining activity, adding incremental downside pressure to global hashrate.

Looking Ahead

As network difficulty responds, the next adjustment is currently estimated for December 25 at approximately -1%, which should provide modest short-term relief. However, hashrate will remain sensitive at the margin, reacting quickly to changes in price, policy, and power.

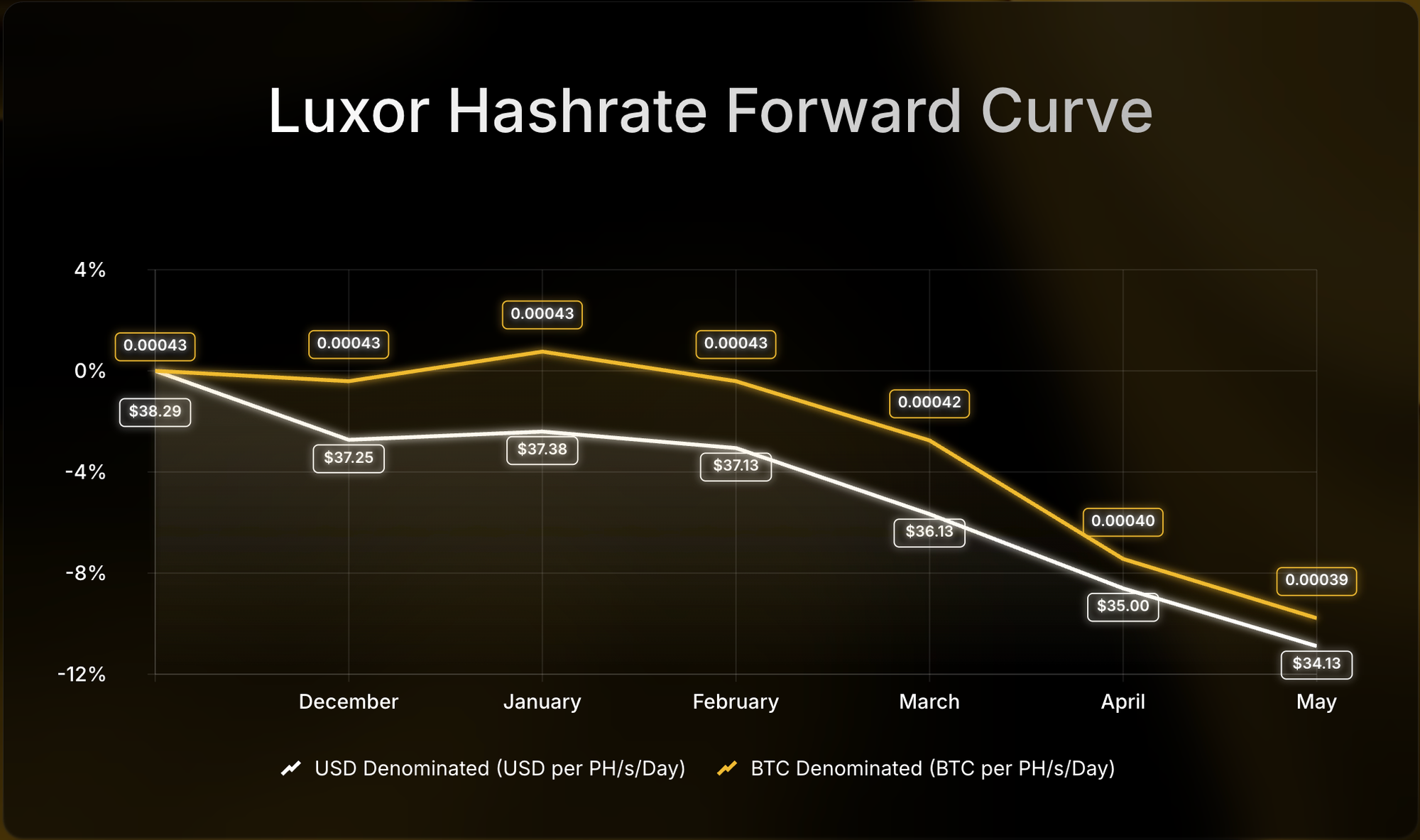

Luxor’s Hashrate Forward Market is already pricing these dynamics, implying expectations of flat hashrate throughout December – February, and for growth to resume into spring. Sellers can currently secure an average hashprice of $36.17 or 0.00041 BTC per PH/s/Day over the next six months, while buyers have the opportunity to lock in the same hashcost through April 2026.

If you’d like to learn more about Luxor’s Bitcoin mining derivatives, please reach out to [email protected] or visit https://www.luxor.tech/derivatives.

About Luxor Technology Corporation

Luxor delivers hardware, software, and financial services that power the global compute and energy industry. Its product suite spans Bitcoin Mining Pools, ASIC Firmware, Hardware trading, Hashrate Derivatives, Energy services, and a bitcoin mining data platform, Hashrate Index.

Disclaimer

This content is for informational purposes only, you should not construe any such information or other material as legal, investment, financial, or other advice. Nothing contained in our content constitutes a solicitation, recommendation, endorsement, or offer by Luxor or any of Luxor’s employees to buy or sell any derivatives or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the derivatives laws of such jurisdiction.

There are risks associated with trading derivatives. Trading in derivatives involves risk of loss, loss of principal is possible.

Hashrate Index Newsletter

Join the newsletter to receive the latest updates in your inbox.